Quote:

Originally Posted by suburbia

These articles are largely about specific types of flood insurance that isn't available irrespective of where you live of type of residence it is. It is rather old news, though I do agree there are additional major challenges in the areas immediately beside our rivers and that are particularly low lying.

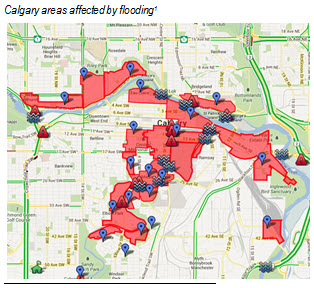

Areas with major insurance issues are depicted on this map:

|

Every article i posted concerns insurance issues which largely affect single family detached owners, including several instances of 50-100%+ premium hikes - effectively many multiples of the insurance hike you brought up with condo owners.

Also I'm not sure why you posted such a zoomed in map, are you deliberately trying to mislead people regarding flooding danger? Just like you deliberately mislead people about crime reports, and deliberately mislead people about insurance?

Here is a zoomed out map of the actual floodway map of Calgary:

Note that effected areas stretch all the way to Cochrane, Heritage point, Nose Creek/Fish Creek, etc.

I'm not sure what the point of this map is though. People will pay a premium to live next to beautiful natural waterways, doesn't matter if they have to pay higher insurance and they certainly generally pay higher for the property. It's true of urban and suburban owners.

Condos have several advantages however, with a well managed reserve fund they are nicely equipped to handle gaps of insurance and pooling money together through a special assessment - higher density towers will generally mean each owners pays less to cover the cost. With a house, you're on the hook for all the insurance gaps. Ouch.

::Trigger Suburbia hibernation mode::