Quote:

Originally Posted by windypeg

I guess you didn't read my post, or have a little bit of trouble with math. Those numbers from the Calgary study are all showing the total taxes paid, not the tax rate. Property tax rates in Winnipeg are 50% higher than the Canadian average.

A rate is a portion of the base amount. A high tax rate might not mean a large tax bill, if the base amount is low. If I make $30k a year and pay 50% income tax, I pay $15k in tax. If you make $100k and pay 25% income tax, you pay $25k in tax. So even though I'm taxed at a much higher rate, I end up paying less in total than you, because I have less to begin with. This is easy math.

Winnipeggers pay among the highest property tax rates in the country. Their total tax bills are still relatively low because the average property value is lower than all other major cities, not just TO and Van. Homeowners in other cities pay lower rates on much higher base amounts, so they end up with higher bills, but they also have more wealth built up in their homes. Their tax bill relative to their assets is much smaller than ours.

https://www.altusgroup.com/wp-conten...ark-Report.pdf

https://www.zoocasa.com/blog/how-pro...a-infographic/

https://www.altusgroup.com/wp-conten...ark-Report.pdf

https://www.zoocasa.com/blog/how-pro...a-infographic/

|

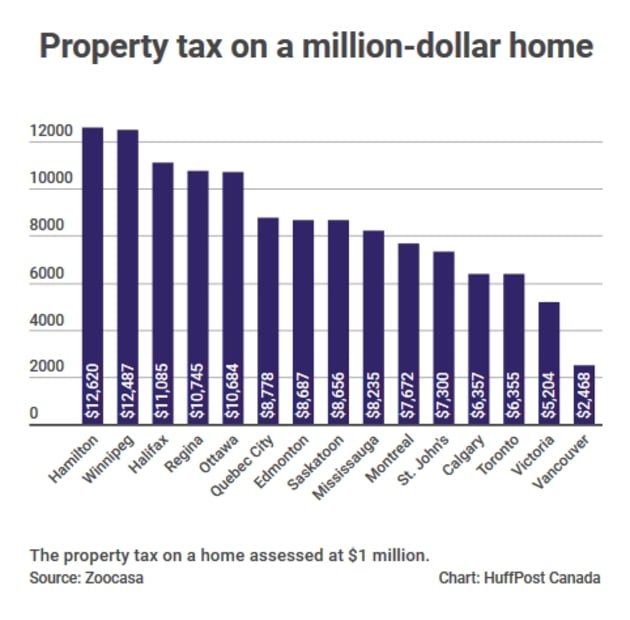

These sources are factually wrong because the people making these graphs are morons and don't take the time to familiarize themselves with each individual city's tax model. Winnipeg's municipal tax model is not the same as every other city's, so when you compare them, you wind up with incorrect values.

The biggest thing that your two sources don't take in to account is the fact that in Winnipeg, you only pay tax on 45% of the assessed value of your home, unlike other jurisdictions. So if your home is assessed at $300,000, you only pay tax on 135,000 of it. This rule is set by our Provincial Government. The fact is that your two sources/graphs do not take this in to account.

So on your first graph, it says that Winnipeg has the highest tax rate (i.e. Mill rate) on $1,000 of assessed property, at $12.15 per $1,000 of assessment. Yes, this is true and in fact in 2018, it's slightly higher at $12.99 per $1,000 of assessment. But again, the key issue here is that our mill rates are artificially inflated because the mill rate only applies to 45% of your assessed value. So sure, our mill rate is the highest, but it's applied to less than half the properties value. If you adjust our mill rate to be the same as other cities in the graph (i.e. take 45% of the mill rate), our mill rate is $5.85 per $1,000 of assessed value, which is second lowest, with only Vancouver being lower.

On your second graph, the math is completely wrong. There's nothing hidden or transparent about our tax applies to property owners. You take the assessed value of a home, multiply it by 0.45, then multiple it by the mill rate divided by 1,000. It's all on the city's website. So by the city's formula, the municipal tax rate on a home assessed at $1million is: 1,000,000*.45*(12.987/1000) = $5,845, which is less than half the $12,487 displayed on those graphs.

As you can see, the media (and many people) don't understand how the system of taxation varies by city, so numbers are mis-represented and it builds incorrect assumptions across Canada. Many people, including yourself, believe that municipal taxes in Winnipeg are the highest in Canada, and rightfully so based on what you've seen in the media. But what the media reports is factually incorrect, but no one takes the time or effort to try to correct them, and even if they did, the media has no incentive to correct their erroneous analysis. The end result is that people believe something that's not true and attempts to show them the truth are disregarded.